Micro-financing: Disrupting the Status Quo of Economic Opportunities in Developing Countries

Microfinance and financial inclusion – two buzzwords you are likely to hear often if you don’t live under a rock. When the concept of microfinancing was first conceived, those responsible probably never envisaged it becoming as widespread as it is today, having an impact in rural areas such as Ariaria, Nigeria. Although it is mostly regarded as a new model of financing businesses, for most people in rural Nigerian communities, microfinancing is not a strange concept as they have a general understanding of the operational and contextual use.

Simply put, microfinance is a type of banking service provided to people or groups, typically low-income individuals, who have no other access to financial services. These individuals could range from the petty trader in Lagos, Nigeria who wakes up at 5am to get her supplies from the wholesale market, to the smallholder farmer in Kenya who is looking for ways to improve crop yield on his farm. In essence, microfinance provides access to financial services, especially lending, to these individuals who cannot access formal bank finance due to requirements such as collateral and business registration.

Microfinance Track Record

Microfinance became famous through Muhammad Yunus’ Grameen Bank – considered one of the largest microfinance institutions in the world. As at October 2021, the Grameen bank had approximately 9.44 million members who were being provided access to micro-credit for investments or emergencies, with 97% of them women.

This novel finance strategy as we know it today leverages a flexible distribution network including mobile bank branches and merchant networks, enabling microfinance services to reach the poor and unbanked in the informal sector, and giving them the resources needed to establish and grow their businesses. Ultimately, this solution enables them to cater for their families with a larger effect on their community’s socio-economic landscape. Hence, it has been established that microfinance is directly involved and is a viable tool in increasing income, increasing financial inclusion, and reducing extreme poverty in developing economies.

It is then no surprise that microfinance is a household name in Africa, a region with the largest informal sector in the world. According to the International Labor Organization, the informal sector claims almost 90% of the Sub-Saharan African economy. Microfinance institutions number in hundreds across some of the top economies in Africa. For instance, in Nigeria, the CBN records over 900 licensed microfinance banks in the country. In Ghana, microfinance includes about 3000 institutions. Furthermore, in Nigeria, microfinance banks have experienced rapid growth, recording up to 82% increase in lending in 2020.

Microfinance in Nigeria

Image source: Nairametrics

Today, the microfinance approach has evolved and taken various forms. In Nigeria, several agencies and organizations both formal and informal have arisen to meet the growing need. Personal findings revealed that 3 out of every 5 small scale and petty traders rely greatly on diverse forms of microfinancing to operate their businesses. Sources I interacted with revealed that some women belong to at least two microfinance schemes and some can be found in up to five.

Despite differences in name, scope, size and structure, most of today’s microfinance outfits maintain focus on the same population segment as traditional finance institutions. Although they offer services which these finance institutions shy away from, some microfinance institutions charge higher interest rates than traditional finance outfits. A typical loan of 50,000 Nigerian naira ($120) can attract an interest rate of 16% payable weekly over a period of 5 months depending on the microfinance outfit. Another interesting revelation is that many people in the middle-income range also largely patronize informal microfinance schemes. But, despite the irregular interest rates, many at the bottom rung of society’s ladder will continue to patronize informal microlenders as formal finance institutions will not consider them when giving business loans and grants. Further, with as little as 200,000 Nigerian naira ($481), a microfinance outfit can be started depending on location, customer needs, market size among other factors. This brings us to the different challenges currently facing microfinance in developing countries.

Challenges With Microfinance

While microfinance is as big as it is today, a number of challenges affect its efficiency and market penetration. One major challenge is the high interest rates with short repayment time frames which are often a huge burden on micro-lenders. Other major challenges facing the microfinance industry are the often tight regulations which make it difficult for some institutions serving the informal sector to obtain operating licenses as well as charge lower interest rates. Personal findings revealed that many of the microfinance bodies serving the economically disadvantaged are not registered or do not have the required licenses thereby operating in the informal economy. This exposes them to a lot of risk as 1 out of 5 people default in payment while another group use the borrowed funds for ventures other than the reason the loan was obtained.

While these microfinance challenges can be seen across various sectors, the peculiarity of its effect in the Nigerian agricultural sector is one which requires the involvement of more stakeholders.

Microfinance and Sectoral Impact: smallholder farmers

It is undeniable that the introduction of microfinance for smallholder farmers is not only a blessing to the agricultural sector, but also a tool to improve food production and ultimately, improve food security to support the achievement of SDG 2 (Zero hunger). This is especially important in Nigeria where an estimated 80% of farmers are smallholder farmers. These farmers are characterized by their use of very basic tools to farm, access to low-quality seeds and fertilizers, low crop yields and extreme poverty.

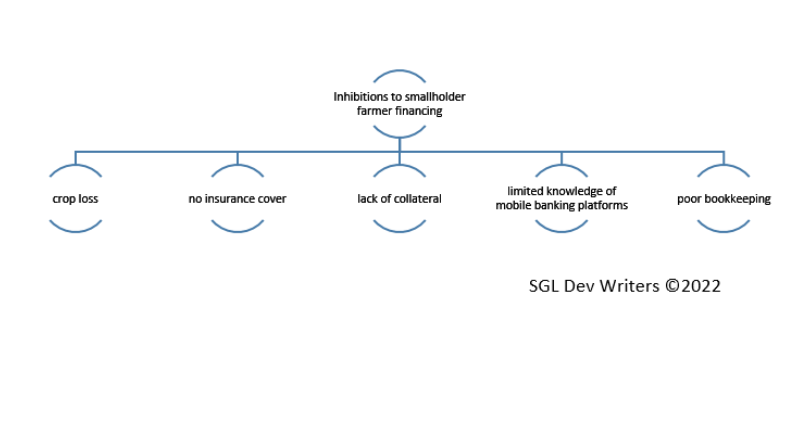

For this category of farmers, microfinance loans have been an avenue that has enabled them to access funds needed to buy seeds, fertilizers as well as agricultural equipment to boost production and profit. However, this is not without its challenges. Whilst it is established that farmers require support to be able to meet the growing needs of the population, microfinance institutions are becoming increasingly concerned about the volatility of the sector. It is well known that smallholder farming is a risky sector to finance, as the farmers could have their entire crops destroyed by parasites or natural disasters, leaving them with no way to repay these loans. With no form of insurance on the business, this leaves a high risk for losing the entire investment. In addition, most farmers have no collateral or guarantees to provide to microfinance institutions as they have no formal records of harvests and finances, nor assets. This makes microfinance institutions vulnerable to loan defaults from smallholder farmers.

Similarly, while mobile banking has been instrumental in reaching remote areas, many of these farmers have little understanding of how loans work on mobile platforms or how best to optimize the value of the loans.

This highlights the need for microfinance institutions that operate hybrid models, where a combination of mobile banking, mobile branches, and community agents prevails. This way, microfinance officers can sensitize farmers on the contract terms of the loan and advise on best uses. In cases where collateral is a barrier to giving loans, these institutions could consider items such as television sets or livestock as collateral. Large enterprises and investors backing such microfinance institutions and providing risk equity will encourage more development in the agricultural sector, especially smallholder farming through microfinance.

The Way Forward

With the huge potential of microfinance especially in the informal economy, it places a demand on regulatory agencies to explore enabling policies so that the institutions operating in the space are able to operate more effectively and obtain cover for some of the risks they take.

While strong regulations are needed in microfinance to ensure efficient fund mobilization, appropriate risk management, transparency, and customer protection, there is a need to ensure these regulations are not ambiguous in the interpretation of lending activities, overly restrictive, or hamper further penetration of microfinance in developing countries.

Microfinance institutions, when strengthened, provide an enormous platform for accelerating socio-economic development in developing countries and contributing to the achievement of the Sustainable Development Goals (SDGs). Presently, across communities in Nigeria,microfinance has proven to be a significant engine in reaching the poor and disadvantaged and supporting them to build their businesses thereby contributing to meeting the first of the 17 UN SDGs “No poverty”. This impact can also be seen in its expansion of economic opportunities thereby impacting Goal 8 – Decent work and economic growth. Another crucial SDG which has been positively impacted by microfinance is Gender equality. With women empowerment being crucial to strong societies, microfinance has provided avenues for more women to be empowered and financially included. Thus, microfinancing is a major enabling development tool in increasing the economic potential and livelihood standard of citizens.

On the whole, over the last decade, microfinance has been at the forefront of disruption in developing countries as well as expanding opportunities to the poor and excluded population segment. It raises the need that to accelerate development of economic progress on the continent, there has been no better time for stakeholders to start being more deliberate in maximizing the impact of microfinancing.

Kenstonia Edende

University of Lagos graduate in Accounting and member of SocialGood Lagos